Securitization means acquisition of financial assets by a securitization or reconstruction company. This process of acquisition (securitization) is resorted to reduce large non performing asset (NPA) i.e. loans or portfolio of loans from a bank or financial institution by a securitization and reconstruction company (SCRC) on mutually agreed terms and conditions. This is a process where non-liquidated financial assets are converted in to Marketable securities i.e. security receipts that can be sold to investors. It is also process of converting receivables and other assets into securities i.e. security receipts that can be placed in market for trading.

On acquisition of financial assets, the SCRC becomes the owner of the financial assets and steps in the shoes o f lender bank or financial institution. The RBI is the regulatory authority for a SCRC. The SCRC is a company registered under the companies Act 1956 for the purpose of securitization and it also needs registration from RBI as per SARFAESI ACT 2002.

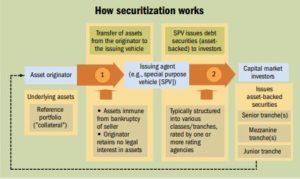

Securitization refers to process of liquidating illiquid assets like loans receivables by issuing marketable securities against them.

Various stage involved are:-

1. Identification- of assets to be securitized

2. Transfer Process:- in favour of Special Purpose Vehicle (SPV) or trust or ARC

3. Issue Process: Issuing securities to investors which are known as pay through certificates or pass through certificates

4. Redemption process: Repayment of principal and interest is made out of collection of securitized assets.

Advantages of Securitization:

– Additional source of funds to originator

– Greater profitability

– Helps originator to have easy access to security market

– Avoids idle capital