General Awareness play a vital role in all Examination. we can expect Questions from different Topics.In Banking and other competitive exams like RRB, CDS, LIC AO, RBI, SSC, UPSC, FCI, UIIC, OICL, SBI Clerks and PO the questions on Crossing of Cheques are being asked. Here we have given Banking awareness study notes on : Crossing of Cheques for SSC CGL Examinations 2019-20 & other examination. Candidates those who are all preparing for the Examination can use this study material.

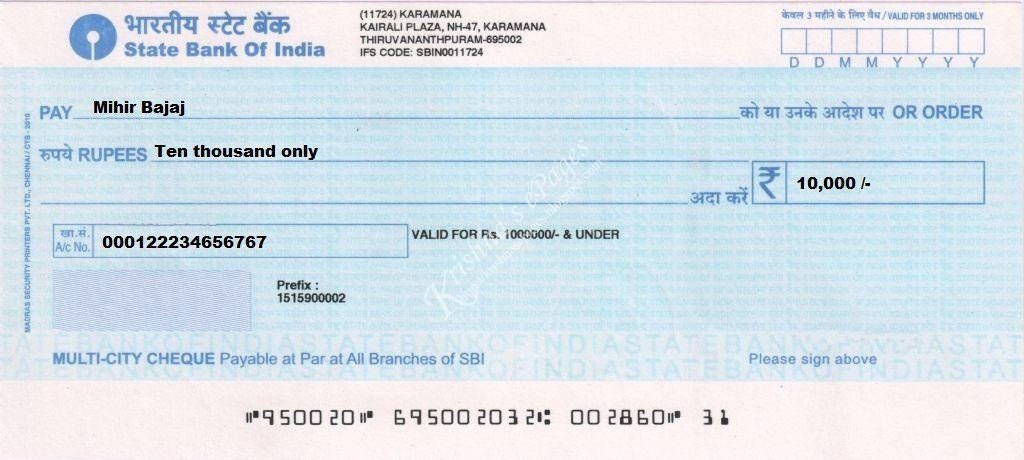

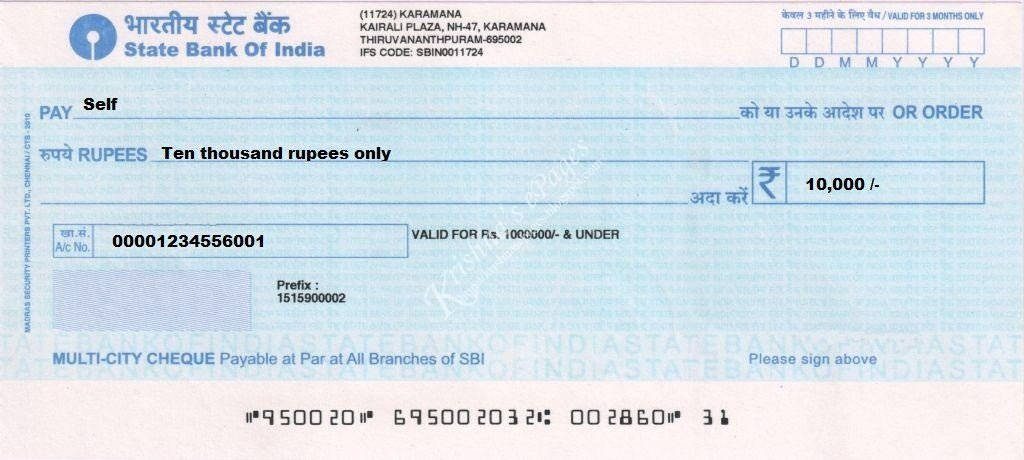

A cheque is a very common form of negotiable instrument. You need a savings bank account or current account in a bank, in order to issue a cheque in your own name or in favor of others, thereby directing the bank to pay the predetermined amount to the individual named in the cheque.

A cheque is a document which ensures the payment of a particular amount of money on demand to a certain individual or to the bearer of the instrument. It is a printed form which You can use to make payment from your bank account. When you write a cheque you enter the amount of money that you want to send to the person and who is to be paid to, sign and hand it over to the individual you want to make payment to. Your bank then pays the money to that individual (payee) from your account.

It is one of the safest and convenient modes of making payments and is transferred by mere delivery.

One of the benefits of the cheque is that you can transfer a high-value transaction without any hassle which would be very difficult if hard cash was used instead.

The issuer of the cheque has an account (savings or current) with the bank to which it is connected. There are various types of cheque books which depend on the type of account you have.

Some of the important details which should be present in a cheque are as follows-

a. A cheque should be dated.

b. A cheque should mention the amount of money in figures and words.

c. A cheque must be signed by the person (Drawer) issuing the cheque

d. A cheque must be drawn upon a specified bank (Drawee).

e. A cheque must have the name of the recipient (Payee) of the cheque.

Different type of cheques

1. Bearer cheque

It is also known as open cheque or uncrossed cheque. This cheque can be transferred by mere delivery and needs no endorsement.

The cheque is negotiable from the date of issue up to three months. It turns stale after the completion of three months and needs to be revalidated before presenting to the bank.

However, these cheques are very risky and once misplaced can lead to the loss of amount stated in the cheque.

2. Self-Cheque

It comes under bearer cheque where instead of writing the name, the account holder writes “self” to receive money physically from the branch where he holds the account.

3. Account Payee Cheque-

A bearer cheque becomes an account payee cheque by writing “Account Payee” or crossing it twice with two parallel lines on the left-hand side top corner.

The amount will be transferred to the account of the person specified on the cheque.

It is considered the safest type of cheque and is also known as a crossed cheque.

4. Post dated cheque

It is a type of a crossed or accounts payee cheque but it is post-dated to meet the obligation at a future date. It is valid from the date of the issue up to three months.

5. Banker’s cheque

Such cheques are issued by the bank itself and guarantees a payment.

6. Traveler’s cheque

You can use such cheques for withdrawal of money while travelling. It is equal to carrying cash but you can travel safely without carrying huge amount. These cheques can be encashed abroad where foreign currency is normally acceptable.

7. Crossed cheque

When we cross a bearer cheque twice with two parallel lines on the left-hand top corner, it becomes a crossed cheque. Only the name written on it can get the amount transferred to his account.

Different Types of Crossing

1. General Crossing :-

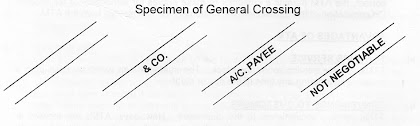

Generally, cheques are crossed when

- There are two transverse parallel lines, marked across its face or

- The cheque bears an abbreviation “& Co. “between the two parallel lines or

- The cheque bears the words “Not Negotiable” between the two parallel lines or

- The cheque bears the words “A/c. Payee” between the two parallel lines.

A crossed cheque can be made bearer cheque by cancelling the crossing and writing that the crossing is cancelled and affixing the full signature of drawer.

Specimen of General Crossing

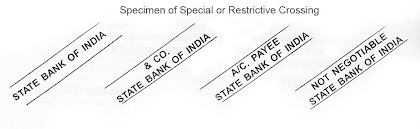

2. Special or Restrictive Crossing :-

When a particular bank’s name is written in between the two parallel lines the cheque is said to be specially crossed.

Specimen of Special or Restrictive Crossing

In addition to the word bank, the words “A/c. Payee Only“, “Not Negotiable” may also be written. The payment of such cheque is not made unless the bank named in crossing is presenting the cheque. The effect of special crossing is that the bank makes payment only to the banker whose name is written in the crossing. Specially crossed cheques are more safe than a generally crossed cheques.

Crossing of Cheques are defined in Section 123 of Negotiable Instrument Act, 1881. There are four types of crossing (i.e., putting conditions on cheque)