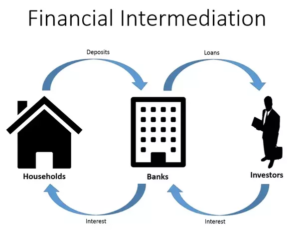

Financial intermediaries are institutions that mediate between ultimate lenders and ultimate borrowers or between those who have surplus money and those who wish to use the money to finance their deficit budgets. The best examples of such financial intermediaries are:

– Banks

– Insurance Companies

– Provident Fund

– Unit Trust of India etc.

The key function of these FI‟s is to collect surplus/savings and lend them to deficit spenders. Banks collect savings from public at large; invest these savings in to loans and advances and investments. Their main source of earning is the difference in borrowing rate and lending rate. They also earn money on various services provided to customers. Same is the case with Insurance Companies as they also collect savings though selling insurance policies.

Advantages to Lenders:

(i) Low risk – Risk of capital loss or interest loss to lender is minimum

(ii) Greater liquidity – The FI‟s offer greater liquidity and lender can convert investment in cash any time.

(iii) Convenience

(iv) Other Services

Advantages to Borrowers

(i) Demand of funds can be met as FI‟s have big pool of funds.

(ii) Certainty of availability of funds

(iii) Rate of interest is reasonable.

(iv) At times, small borrowers get preferential treatment.

Types of financial intermediaries

According to the dominant economic view of monetary operations, the following institutions are or can act as financial intermediaries:

♦Banks

♦Mutual savings banks

♦Savings banks

♦Building societies

♦Credit unions

♦Financial advisers or brokers

♦Insurance companies

♦Collective investment schemes

♦Pension funds

♦cooperative societies

♦Stock exchanges