Charge denotes an impediment over the title of the property, i.e. when the charge is created on an asset, the asset is not allowed to be sold or transferred. Basically, there are three ways through which charge is created on the property, that are classified according to the movability of the asset, i.e. On movable property, the charge is created by way of pledge or hypothecation, whereas when the charge is created on an immovable asset, then it is known as Mortgage.

Definition of Mortgage

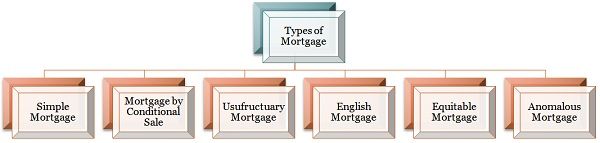

The mortgage can be defined as the transfer of interest, in a particular immovable asset such as building, plant & machinery, etc. in order to secure payment of the funds borrowed or to be borrowed, an existing or future debt from the bank or financial institution, that results in the rise of pecuniary liability.

It is something in which special interest in the property mortgaged, is transferred by the mortgagor in favor of the mortgagee, so as to assure the payment of money advanced. The ownership of the property remains with the mortgagor (borrower/transferor), but the possession is transferred to the mortgagee (lender/transferee). When the mortgagor does not make payment in time, the mortgagee can sell the asset, after giving a notice to the mortgagor.

Definition of Charge

By the term ‘charge’ we mean, a right created by the borrower on the property to secure the repayment of debt (principal and interest thereon), in favor of the lender i.e. bank or financial institution, which has advanced funds to the company. In a charge, there are two parties, i.e. creator of the charge (borrower) and the charge-holder (lender). It can take place in two ways, i.e. by the act of the parties concerned or by the operation of law.

When a charge is created over securities, the title is transferred from the borrower to the lender, who has the right to take possession of the asset and realize the debt through legal course. The charge on various assets is created according to their nature, such as:

- On Movable stocks: Pledge and Hypothecation

- On Immovable property: Mortgage

- On Life such as insurance policy: Assignment

- On Deposits: Lien

Types of Charge

- Fixed Charge: The charge which is created on ascertainable assets, i.e. the assets which do not change their form like land and building, plant and machinery, etc. is known as fixed charge.

- Floating Charge: When the charge is created over unascertainable assets, i.e. the assets which change its form like debtors, stock, etc. is called floating charge.

| BASIS FOR COMPARISON | MORTGAGE | CHARGE |

|---|---|---|

| Meaning | Mortgage implies the transfer of ownership interest in a particular immovable asset. | Charge refers to the security for securing the debt, by way of pledge, hypothecation and mortgage. |

| Creation | Mortgage is the result of the act of parties. | Charge is created either by the operation of law or by the act of the parties concerned. |

| Registration | Must be registered under Transfer of Property Act, 1882. | When the charge is a result of the act of parties, registration is compulsory otherwise not. |

| Term | Fixed | Infinite |

| Personal Liability | In general, mortgage carries personal liability, except when excluded by an express contract. | No personal liability is created, however, when it comes into effect due to a contract, then personal liability may be created. |