RBI : Its functions & Role

The Reserve Bank of India was established in the year 1935 in accordance with the Reserve Bank of India Act, 1934. The Reserve Bank of India is the central Bank of India entrusted with the multidimensional role. It performs important monetary functions from issue of currency note to maintenance of monetary stability in the country. Initially the Reserve Bank of India was a private share holder’s company which was nationalized in 1949. Its affairs are governed by the Central Board of Directors appointed by the Government of India. Since its inception the Reserve Bank of India had played an important role in the economic development and monetary stability in the country.

The Royal Commission on Indian Currency and Finance appointed on August 25, 1925 has suggested the establishmentof the Central Bank in India, later the Indian Central Banking Enquiry Committee, 1931 stressed the establishment of the Central Bank in India. The Reserve of Bank was established on April 1, 1935 under the Reserve Bank of India Act, 1934.The main object of Reserve of India is,

“to regulate the issue of Bank notes and the keeping of reserves with a view to securing monetary stability in India and generally to operate the currency any credit system of the country to its advantage”

The Reserve Bank of India was established as a private share holder’s bank. The Central office of Reserve Bank of India was initially located in Calcutta which was later shifted to Bombay. The Reserve Bank of India issued first of its currency notes in January 1938 in denomination of Rs.5 and Rs.10 and later in the same year denomination of Rs.100, Rs.1000 and Rs.10000 were issued

Post Independence

The Reserve Bank of India was nationalized in the year 1949 through the Reserve Bank (Transfer of Public Ownership) Act, i948 and all shares were transferred to Central Government. The Reserve bank of India is constituted for the management of currency and for carrying the business of banking in accordance with provisions of the Act. It is a body corporate having perpetual succession, common seal and can be sued or sue in its name. The general supervision and direction of the affairs of the Reserve Bank is entrusted with Central Board of Directors.

Composition of Central Board

The Central Board consists of Governor, deputy Governor, Ten Director nominated by the Central Government and two Government official nominated by the Central Government. The deputy Governor and Director are eligible to attend meeting of the Central Board but are not entitled to vote. The Governor and deputy Governor hold office for term of five years and are entitled for a re-appointment. The Directors are appointed for a term of four and hold office during the pleasure of the president. The meeting of the Central Board is convened at least six times in a year.

Composition of Local Board

A local board is formed in each four zones consisting of five members which are appointed by the Central Government. There is Chairperson of the Board who is elected among the member. The members of the Board have a hold office for a term of four years and eligible for reappointment. The Local Board advice on matters referred to it by the Central Board and performs duties delegated to it by the Central Board.

a) Traditional functions

b) Development functions

c) Supervisory functions

(A) TRADITIONAL FUNCTIONS OF RBI

(B) DEVELOPMENTAL FUNCTIONS OF RBI

(C) SUPERVISORY FUNCTIONS

The supervisory functions of RBI are discussed as under:

1. Granting Licence to Banks

The non – bank financial institutions are not influenced by the working of a monitory policy. RBI has a right to issue directives to the NBFIs from time to time regarding their functioning. Through periodic inspection, it can control the NBFIs.4. Implementation of Deposit Insurance Scheme

The RBI has set up the Deposit Insurance Guarantee Corporation in order to protect the deposit of small depositors. All bank deposits below Rs. 1 Lakh are insured with this corporation. The RBI work to implement the Deposit Insurance Scheme in case of a bank failure.

Facts about RBI

| 1. | India’s central banking institution/authority |

| 2. | Controls Monetary policy of the Indian rupee |

| 3. | Est. 1 Apr,1935 during the British Raj under RBI ACT 1934 |

| 4. | Nationalized in 1st Jan,1949 |

| 5. | Member bank of the Asian Clearing Union |

| 6. | Providing license to New Banks |

| 7. | It regulate, control & inspects the bank in India |

| 8. | Share capital fully paid initially owned by private shareholders |

| 9. | It plays an important part in the development strategy of the govt. of India |

| 10. | Consist of 21 members

|

Public Sector Bank

Private Sector Bank

Foreign Bank

Example: FB, BOA , Catholic Bank

Types of foreign currency accounts

Public Sector Bank (PSB)

- 1969 ‘s 14 Bank nationalised

- 1981 ‘s again 6 Bank nationalised

- 1993 2 merge bank New Bank of India & PNB

- 19 + IDBI + SBI + 5 Associate Of SBI + Bhartiya Mahila Bank

Subsidiary of RBI

- Fully owned by Govt.

- national Housing Bank (NHB)

- Insurance Credit & Depository

- (NBARD) National Bank of Agric. & Rural Development

Monetary Policy

- made by RBI

- Main function of RBI

- Monetary Policy review after 45 days

CRR ( Cash Reserve Ratio)

- Every Bank need to maintain in the form cash

- 4 % of NDTL ( Net Demand & Time Liability )

SLR ( Statutory Liquidity Ratio )

- 20.00 % of NDTL

- In the form of Gold, Govt. Securities which are easily converted into cash.

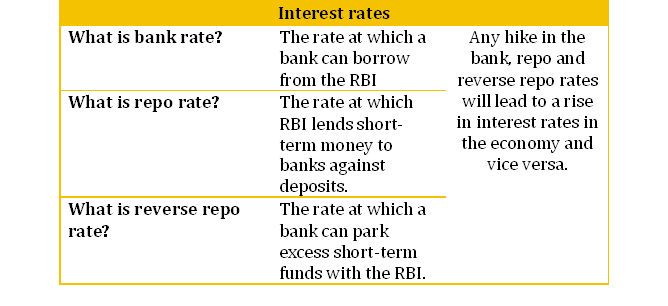

Repo Rate

- When bank lends money from RBI certain interest has to paid by bank.

- For Short Termmore than 2 days upto 90 days

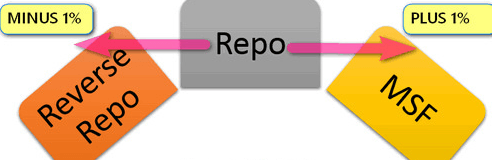

- There will be always minimum difference between Repo Rate & Reverse Repo Rate is 1%

Reverse Repo Rate

- When bank deposit surplus amount with RBI certain interest has to paid by RBI.

Marginal Standing Facility (MSF)

- Same as Repo Rate ( Scheduled Bank borrow funds overnight from RBI)

- Short term upto 90 days

- upto 2 % of NDTL

Bank Rate

- long term

- Same as Repo Rate

Base Rate

- Fixed by RBI

- Below it No loan can provided by any Bank

- PLR(Prime Lending Rate)

- Fixed by Bank

- Loan provided by banks to his customers

Monetary Policy of RBI :

As discussed earlier, RBI executes Monetary Policy for Indian Economy. The RBI formulates monetary policy twice a year. It reviews the policy every quarter as well. The main objectives of monitoring monetary policy are:

- Inflation control

- Control on bank credit

- Interest rate control

The monetary policy (credit policy) of RBI involves the two instruments given in the flow chart below:

Quantitative Measures

Quantitative measures refer to those measures that affect the variables, which in turn affect the overall money supply in the economy.

Instruments of quantitative measures:

Bank rate −The rate at which central bank provides loan to commercial banks is called bank rate. This instrument is a key at the hands of RBI to control the money supply in long term lending.

- Increase in the bank rate will make the loans more expensive for the commercial banks; thereby, pressurizing the banks to increase the rate of lending. The public capacity to take credit at increased rates will be lower, leading to a fall in the volume of credit demanded.

- The reverse happens in case of a decrease in the bank rate. This increases the lending capacity of banks as well as increases public demand for credit and hence will automatically lead to a rise in the volume of credit flowing in the economy.

Liquidity Adjustment Facility-

Reserve Bank of India’s LAF helps banks to adjust their daily liquidity mismatches. LAF has two components – repo (repurchase agreement) and reverse repo.

(i) Repo Rate: Repo (Repurchase) rate is the rate at which the RBI lends shot-term money to the banks against securities. When the repo rate increases borrowing from RBI becomes more expensive.Repo rate is always higher than the reverse repo rate.

(ii) Reverse Repo Rate: It is the exact opposite of repo. In a reverse repo transaction, banks purchase government securities form RBI and lend money to the banking regulator, thus earning interest. Reverse repo rate is the rate at which RBI borrows money from banks.The banks use this tool when they feel that they are stuck with excess funds and are not able to invest anywhere for reasonable returns.

(iii)Marginal Standing Facility (MSF): is a new scheme announced by the Reserve Bank of India (RBI) in its Monetary Policy (2011-12). The MSF would be a penal rate for banks and the banks can borrow funds by pledging government securities within the limits of the statutory liquidity ratio SLR.

The scheme has been introduced by RBI for reducing volatility in the overnight lending rates in the inter-bank market and to enable smooth monetary transmission in the financial system.

Varying reserve ratios –

The reserve ratio determines the reserve requirements that banks are liable to maintain with the central bank. These tools are:

(i) Cash Reserve Ratio (CRR)

It refers to the minimum amount of funds in cash( decided by the RBI) that a commercial bank has to maintain with the Reserve Bank of India, in the form of deposits. An increase in this ratio will eventually lead to considerable decrease in the money supply. On the contrary, a fall in CRR will lead to an increase in the money supply. Currently, it is 4%.

(ii) Statuary Liquidity Ratio (SLR)

SLR is concerned with maintaining the minimum percentage( fixed by RBI) of assets in the form of non-cash with itself. The flow of credit is reduced by increasing this liquidity ratio and vice-versa. As SLR rises the banks will be restricted to pump money in the economy, thereby contributing towards decrease in money supply. The reverse case happens if there is a fall in SLR, it increases the money supply in the economy.