Sales book is a subsidiary book maintained to record credit sale of goods. Goods mean the items in which the business is dealing. These are meant for regular sale. Cash sale of goods and sale of property and assets whether for cash or on credit are not recorded in the sales book. This book is also named as sales day book, sold day book, sales journal or sale register.

The preparation of the sales book is similar to that of purchases book. The entries are made in the sales book on the basis of copies of the invoice sent to the buyer.

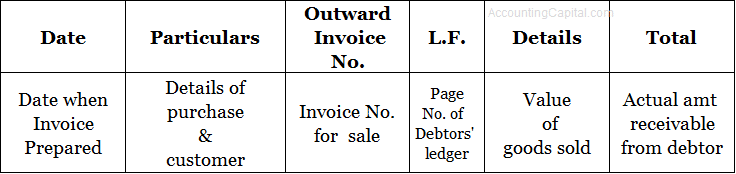

Format

In the date column of the sales book, the date of credit sales is recorded. Particulars column contains the name of party purchasing goods or the party to whom goods have been sold. It also shows the details of goods as regards its quantity, quality, other descriptions and the rate of trade discount allowed. In Ledger Folio (L.F.) column the page number of debtors account in the ledger is recorded for reference. The amount of various items of the goods sold is entered in the details column. Adjustments for trade discount, packing charges, etc., are made in the details column. In the total column, the net amount payable by individual customer is recorded. The total of the amount column is the total credit sales during the period.

Posting from sales book

After the transactions are recorded in the sales book, posting them to ledger involves two steps:

Step 1: Posting to personal accounts of debtors: Every day, each entry is posted to the debit side of the respective personal account of the debtor.

Step 2: Posting to Sales account: At the end of the month, the aggregate of the sales is posted to the credit side of sales account by writing the words ‘By Sundry debtors A/c’.