Digital Banking

Digital Banking is the new paradigm that offers considerable benefits to banks in terms of increasing productivity and profitability. It is accomplished by leveraging state-of the-art technology infrastructure to bring about changes in internal processes and external interfaces.

Objectives Of Digital Banking:

If financial entities want to survive the digitalization of their industry, and even thrive by taking full advantage of the new paradigms, they must pursue six high-priority objectives.

- Develop consumer-centered business models, including a digital experience that differentiates them from the competition and that addresses new purchasing behaviors. According to a PWC study, 30% of financial entities believe that improving the user experience is the most important element of their digital strategy.

- Optimize distribution. The user’s experience needs to be increasingly multi-channel, especially when it comes to online, mobile, and social media.

- Simplify processes and transactions. Rather than simply moving off-line processes on-line, they need to be re-thought from a 100% digital perspective

- Obtain relevant information. Gaining the capability and the tools required to obtain relevant information from Big Data will be a clear competitive advantage.

- Innovate proactively. This may be one of the most profound changes to company culture in this industry: a transition to proactive innovation that seeks and favors change

- Invest in security for verifying user identity and for making data and transactions secure.

Barriers To Digital Banking

The digital transformation of the financial industry also has its dark side, consisting of obstacles to be overcome. So, what is stopping the banking industry from taking full advantage of the digital revolution?

- The banks’ own complex, traditional, centralized systems.

- The regulatory environment.

- Lack of funding.

- Cultural organization.

- Lack of talent and/or skills.

Lack of involvement by upper management

These are barriers that can’t be solved overnight, and that represent a major drag on the industry.

And as happens with change in any industry, there are certain entities that take a leadership role, while others remain tied down by traditional methods and ways of thinking.

As an example, BBVA not only invests in technology; it has also committed to digital change through a new corporate culture, with more streamlined and flexible work methods. In addition, it acquired Spring Studio, a start-up the specializes in user experience, and Openpay, an e-commerce start-up, as part of its strategy to implement new technologies.

What we still don’t know is where the industry as a whole stands. The technologies are there. Internal change may turn out to be the most difficult obstacle of all.

For each query, there is a machine-like CDM (Cash deposit machine), Passbook machine, ATM etc. Digital banking is not only for customers but also for bankers, they are using CSM (cash sorting machine) for cash-counting, Digital lamps for cheque verification, enhanced software’s for calculations and data storage, they use different software’s to update their all inventories of bank-like cheque books, account-opening kit, debit-credit cards, locker details etc.

Internet banking, Mobile banking, Wallet banking, Customer Service, Digital Cash, ATM, SMS Services and IVR calling are some of the examples of digital banking that we use in day to day life.

Some of the features available through online banking:-

- View balances: Checking your balance doesn’t require much work. You simply select Account balances and take a look at your balance and past transactions. If you have more than one account, you can also do transfers between accounts.

- Pay bills: To pay your bills online, you just need to add to your account the names of the companies you wish to pay bills to. In the Pay Bills section, select Add payees, search for the name of the company and fill in the account number for each company. You can also sign up for the ebills service from epost, a service that sends you a bill by email instead of a printed one by regular mail.

- Transfer funds: When you select Transfer Funds, you’ll be asked where to transfer the money to and from, when, and the amount.

- Set up recurring bill payments or transfers: If you make a regular payment every month, it might be convenient to set up an automatic withdrawal from your account.

- Monitor CIBC investments: If you have any CIBC investments, you can keep an eye on those stocks or mutual funds here.

- Send and receive an INTERAC e-TransferTM2: This could be the end of the birthday cheque! You can receive transfers from other people’s accounts, or set up transfers from your account to someone else’s. The recipient will get an e-mail notifying them of the transaction.

- View CIBC VISA* accounts: Always a good place to monitor your spending. You can make your credit card payments online, right from your account.

- Order cheques: We don’t need them much anymore due to online banking and debit purchases, but if you still use cheques, you can order them directly from the CIBC website.

Internet Banking

Internet Banking is a convenient way to do banking services like – Fund transfer, Bill payment, Check account balance, etc. from the comfort of your home or office. Avoid the queue or delays and try our simple and secure Internet Banking facility for an unmatched online banking experience.

Mobile Banking

Away from home, balance enquiries can be made and/or money sent to the loved ones or bills can be paid anytime 24×7!!!

The service is available on java enabled /Android mobile phones (with or without GPRS) /i-phones where the user is required to download the application on to the mobile handset. The service can also be availed via WAP on all phones (java/non java) with GPRS connection.

The following functionalities are available:

- Funds transfer (within and outside the bank)

- Immediate Payment Services (IMPS)

- Enquiry services (Balance enquiry/ Mini statement)

- Cheque book request

- Demat Enquiry Service

- Bill Payment (Utility bills, credit cards, Insurance premium), Donations, Subscriptions

- Mobile /DTH Top up

- Commerce (Merchant payments, SBI life insurance premium)

- Mobile Banking Service over SMS

Core Banking System (CBS)

Today Banking as a business has grown tremendously and transformed itself from only a deposits taking and loan providing system to an institution which provides an entire gamut of products and services under a wide umbrella. All such activities commenced by a bank is called Core Banking.

As per pure definition Core banking refers to a centralized system established by a bank which allows its customers to conduct their business irrespective of the bank’s branch. Thus, it removes the impediments of geo-specific transactions. In fact, CORE is an acronym for “Centralized Online Real-time Exchange”, thus the bank’s branches can access applications from centralized data centers.

Other than retail banking customers, core banking is now also being extended to address the requirements of corporate clients and provide for a comprehensive banking solution.

Core banking solutions offer the following advantages to the bank:

- Improved operations which address customer demands and industry consolidation

- Errors due to multiple entries eradicated

- Easy ability to introduce new financial products and manage changes in existing products

- Seamless merging of back office data and self-service operations.

Minimum features of Core Banking Solution:

- Customer-On Boarding.

- Managing deposits and withdrawals.

- Transactions management

- Interest. Calculation and management.

- Payments processing (cash, cheques /checks, mandates, NEFT, RTGS etc.).

- Customer relationship management (CRM) activities.

- Designing new banking products.

- Loans disbursal and management.

- Accounts management

- Establishing criteria for minimum balances, interest rates, number of withdrawals allowed and so on.

Customers find core banking advantageous since:

- The entire range of banking products including savings, deposit accounts etc are available from any location

- Accessibility through multiple channels, including mobile banking and web

- Accurate, timely and actionable information about customer relations

- Single view between bank and customers

- Redefining the concept of ‘anywhere, anytime’ banking.

National Electronic Fund Transfer (NEFT)

It is a payment system which facilitates one-to-one funds transfer. Under this facility, any customer can electronically transfer funds from any bank branch to any individual, firm or corporate having an account with any other bank branch in the country.

There is no limit – either minimum or maximum – on the amount of funds that could be transferred using NEFT. However, maximum amount per transaction is limited to ₹50,000/- for cash-based remittances within India and also for remittances to Nepal under the Indo-Nepal Remittance Facility Scheme.

Presently, NEFT operates in hourly batches – there are twelve settlements from 8 am to 7 pm on week days (Monday through Friday) and six settlements from 8 am to 1 pm on Saturdays.

What is IFSC?

IFSC or Indian Financial System Code is an alpha-numeric code that uniquely identifies a bank-branch participating in the NEFT system. This is an 11 digit code with the first 4 alpha characters representing the bank, and the last 6 characters representing the branch. The 5th character is 0 (zero). IFSC is used by the NEFT system to identify the originating / destination banks / branches and also to route the messages appropriately to the concerned banks / branches.

The beneficiary can expect to get credit for the NEFT transactions within two business hours (currently NEFT business hours is from morning 8 AM to evening 7 PM on all week days and from morning 8 AM to afternoon 1 PM on Saturdays) from the batch in which the transaction was settled.

Real Time Gross Settlement (RTGS)

The acronym ‘RTGS’ stands for Real Time Gross Settlement, which can be defined as the continuous (real-time) settlement of funds transfers individually on an order by order basis (without netting). ‘Real Time’ means the processing of instructions at the time they are received rather than at some later time; ‘Gross Settlement’ means the settlement of funds transfer instructions occurs individually (on an instruction by instruction basis). Considering that the funds settlement takes place in the books of the Reserve Bank of India, the payments are final and irrevocable.

The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is ₹2 lakh. There is no upper ceiling for RTGS transactions.

Under normal circumstances the beneficiary branches are expected to receive the funds in real time as soon as funds are transferred by the remitting bank. The beneficiary bank has to credit the beneficiary’s account within 30 minutes of receiving the funds transfer message.

The RTGS service window for customer’s transactions is available to banks from 9.00 hours to 16.30 hours on week days and from 9.00 hours to 14:00 hours on Saturdays for settlement at the RBI end. However, the timings that the banks follow may vary depending on the customer timings of the bank branches.

Indian Financial System Code (IFSC)

IFSC is short for Indian Financial System Code and represents the 11 digit character that you can usually see on your bank’s cheque leaves, or other bank sponsored material. This 11 character code helps identify the individual bank branches that participate in the various online money transfer options like NEFT and RTGS.

Note: IFSC code represent –

- First 4 alpha characters indicate – bank name

- Fifth characters is – 0

- Last 6 characters indicate – bank branch.

For e.g.- SBIN0000127 – Here – SBIN indicates – State Bank of India. 0127 represent the Gorakhpur Main Br. name.

National Payments Corporation of India (NPCI)

National Payments Corporation of India (NPCI) is an umbrella organization for all retail payments system in India. It aims to allow Indian citizens to have unrestricted access to ‘e-payment’ services. It was set up with the guidance and support of the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA). Its headquarter located in Mumbai, Maharashtra.

The organization is owned by a consortium of major banks and has been promoted by the country’s central bank, the Reserve Bank of India (RBI). Its recent work of developing Unified Payments Interface (UPI) aims to move India to a cashless society with only digital transactions.

Unified Payments Interface (UPI)

It is an instant payment system to transfer money between two parties bank accounts. It is similar to NEFT or RTGS transfers in that way. It is developed by the National Payments Corporation of India (NPCI).

The different channels for transferring funds using UPI are:

- Transfer through Virtual ID

- Account Number + IFSC

- Mobile Number + MMID

- Aadhaar Number

- Collect / Pull money basis Virtual ID

Immediate payment service (IMPS)

Immediate Payment Service (IMPS) is an instant real-time inter-bank electronic funds transfer system in India. IMPS offers an inter-bank electronic fund transfer service through mobile phones. Unlike NEFT and RTGS, the service is available 24/7 throughout the year including bank holidays.

It is managed by the National Payments Corporation of India (NPCI) and is built upon the existing National Financial Switch network.

The benefits of IMPS –

- Instant money transfer.

- Available 24 x7 (functional even on holidays)

Transaction limit – There is a maximum limit of Rs. 2 lakhs.

- To transfer fund, account number & IFSC code of Payee is needed.

- This facility is available in internet banking of every bank.

Interbank Mobile Payment Service (IMPS)

Interbank Mobile Payment Service (IMPS) is an instant interbank electronic fund transfer service through mobile phones. IMPS facilitates customers to use mobile instruments as a channel for accessing their banks accounts and remitting funds therefrom. Customer should enroll for Mobile Banking Service with the bank where customer has an account. The customer needs to have a bank account with the bank which has enabled this facility.

The beneficiary details required are:

- Beneficiary’s mobile number

- MMID of the beneficiary customer

Note:

- To transfer fund, only MMID and Registered Mobile Number of Payee is needed.

- The account number and IFSC code are not required for fund transfer.

- Mobile Money Identifier (MMID) is a 7digit number which is issued by banks.

- IMPS is functional through the National Financial Switch (NFS) of NPCI, which is also used for routing ATM transactions.

Transaction Limits – RBI has defined the maximum limit per day transaction. If the transaction happens in an encrypted format (from net banking) then limit is 50,000 rupees per day whereas if the transaction happens in unencrypted messaging formats (from mobile instrument via text message) then limit is 1,000 rupees per day.

The benefits of IMPS –

- Instant money transfer.

- Available 24 x7 (functional even on holidays)

*99# Service

*99# is a USSD (Unstructured Supplementary Service Data) based mobile banking service from NPCI that brings together diverse ecosystem partners such as Banks & TSPs (Telecom Service Providers). Using *99# service, a customer can access financial services by dialling *99# from his/her mobile registered with the bank. The service works across all GSM service providers and handsets.

What is USSD?

Unstructured Supplementary Service Data (USSD) is a technology unique to GSM (Global System for Mobile Communications) handsets. It is a capability built into the GSM standard to support transmitting information over the signalling channels of the GSM network. USSD provides session based communication, enabling a variety of applications. USSD technology, which was primarily used in the field of telecommunication, is going to make a significant impact in the field of banking services.

What are the key features of *99# service?

- Works without Internet – Uses voice connectivity

- Accessible through a common code *99# across all TSPs

- No additional charges while roaming for using the service

- Works across all GSM service providers and mobile handsets

- Round the clock availability to customers (works even on holidays)

- No need to install any application on mobile handset to use the service

- Additional channel for banking services and key catalyst for financial inclusion

What are the various services available under *99#?

*99# service can be used by the customers for the following purposes:

- Financial

- Non-Financial

- Value Added Services (VAS)

Aadhar Enabled Payment System (AEPS)

AADHAAR Enabled Payment System provides basic financial services (cash deposit,balance enquiry, cash withdrawal and remittance) at low cost access devices (called MicroATMs) maintained at Business correspondents in an inter-operable way.

The 5 AADHAAR enabled basic types of banking transactions are:

- Cash Withdrawal

- Cash Deposit

- AADHAAR to AADHAAR Funds Transfer

- Balance Enquiry

- Gateway Authentication Service

The four AADHAAR enabled basic types of banking transactions are as follows:-

- Balance Enquiry

- Cash Withdrawal

- Cash Deposit

- AADHAAR to AADHAAR Funds Transfer

Aadhaar Payments Bridge System (APBS)

.png)

A centralised electronic benefit transfer system to undertake direct mandates from respective sponsor or accredited bank attached to various government departments for the purpose of disbursing entitlements using Aadhaar numbers.

Objectives of Aadhaar Payment Bridge System (APBS):

Aadhaar Payment Bridge Solution (APBS) will be used to

- Credit disbursements based on UID number,

- To sub-serve the goal of Government of India (GOI) and Reserve Bank of India (RBI) in furthering Financial Inclusion by way of processing government disbursement using Aadhaar number,

- To support various Schemes like NREGA, Social Security Pension, Handicapped Old Age Pension etc. of any Central or State Government bodies, to send financial details to the beneficiary using Aadhaar number.

Features of Aadhaar Payment Bridge System (APBS)

- Pre supposes that all Government beneficiaries would have Aadhaar linked account number

- Government Department can send file containing IIN, Aadhaar No and Amount

- APBS will receive the disbursal payment instruction from the Government Departments through Sponsor Bank – (Banks has ability to convert in the required format)

- The bank identifier would be used to route transaction to the destination bank – the destination bank will maintain the linkage to Aadhaar number and bank account for seamless credit to the customer

- Enriched MIS to participants

- Secure Clearing and Settlement

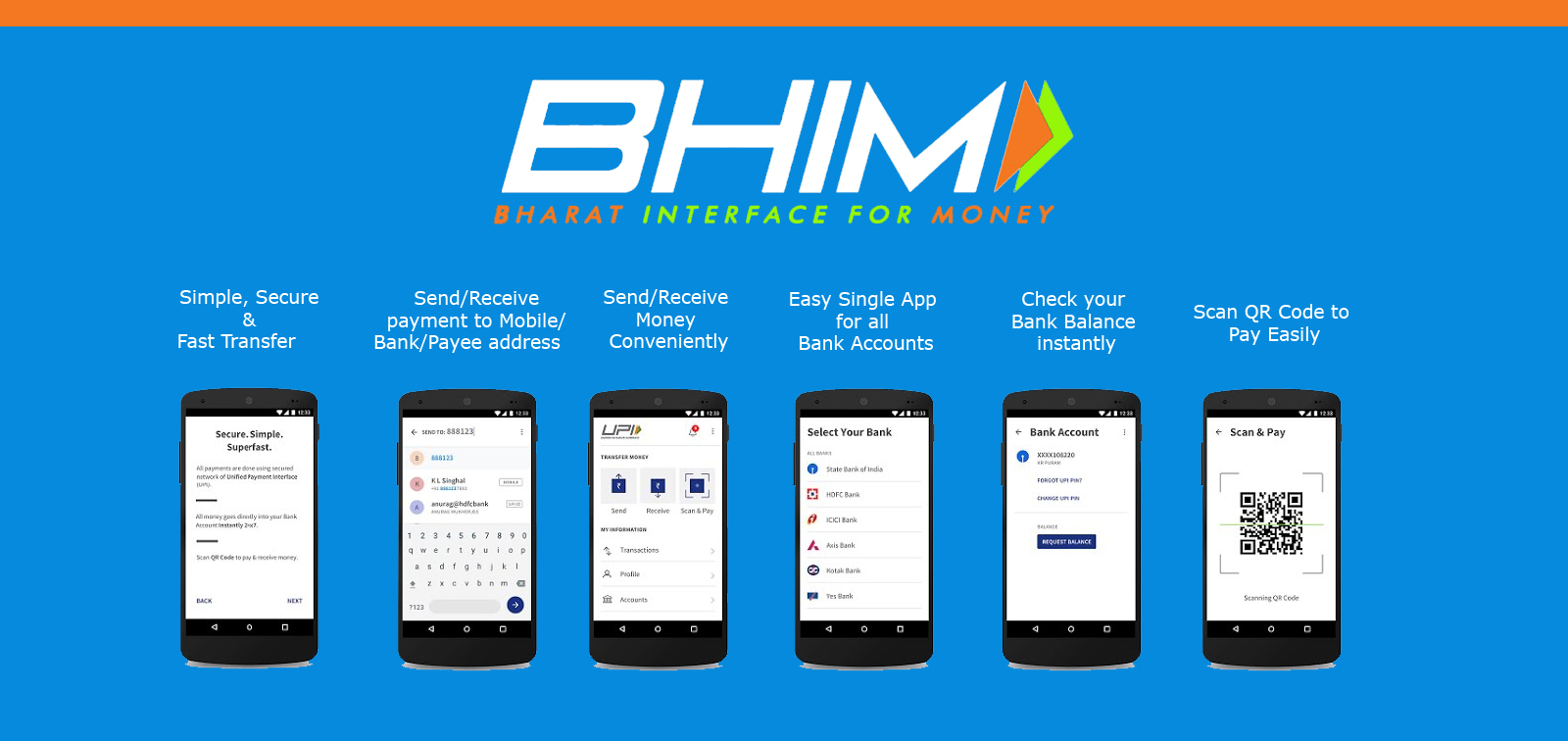

BHIM APP

Bharat Interface for Money (BHIM) is an app that lets you make simple, easy and quick payment transactions using Unified Payments Interface (UPI). You can make instant bank-to-bank payments and Pay and collect money using just Mobile number or Virtual Payment Address (VPA).

The following are the features of BHIM:

- Send Money:User can send money using a Virtual Payment Address (VPA), Account Number & IFSC, Aadhaar Number or QR code.

- Request Money: User can collect money by entering Virtual Payment Address (VPA). Additionally through BHIM App, one can also transfer money using Mobile No. (Mobile No should be registered with BHIM or *99# and account should be linked)

- Scan & Pay: User can pay by scanning the QR code through Scan & Pay & generate your QR option is also present.

- Transactions: User can check transaction history and also pending UPI collect requests (if any) and approve or reject. User can also raise complaint for the declined transactions by clicking on Report issue in transactions.

- Profile:User can view the static QR code and Payment addresses created or also share the QR code through various messenger applications like WhatsApp, Email etc. available on phone and download the QR code.

- Bank Account: User can see the bank account linked with his/her BHIM App and set/change the UPI PIN. User can also change the bank account linked with BHIM App by clicking Change account provided in Menu and can also check Balance of his/her linked Bank Account by clicking “REQUEST BALANCE”

- Language:Up to 8 regional languages (Tamil, Telugu, Bengali, Malayalam, Oriya, Gujarati, Kannada ,Hindi) available on BHIM to improve user experience.

- Block User:Block/Spam users who are sending you collect requests from illicit sources.

- Privacy:Allow a user to disable and enable mobilenumber@upi in the profile if a secondary VPA is created (QR for the disabled VPA is also disabled).

Key Features of BHIM App –

- Maximum limit- User can transfer maximum amount upto Rs 20,000in a day.

- You can send upto Rs. 10,000 in a single transaction.

- Transaction Charges – There is no transaction charges.

- You can transfer money to any bank account.

- No need of activating ‘internet banking’ to use BHIM APP.

- You can transfer money to a person using his mobile number.

Note–

- UPI PIN– It is a four or six digit number which is set by the users itself on BHIM after the registration process. UPI PIN is used for authenticating all transactions done on UPI platform (BHIM or *99# or UPI apps).

- VPA – Virtual Payment Address (VPA) is a unique identifier which you can use to send and receive money on UPI.

Note: You can use two VPA’s. First one is the default VPA (mobile number@upi). The second one, you can create on “My Profile” page.

How can you send money on BHIM? Users can send money by using one of the following details of the beneficiary.

- VPA (Registered on UPI)

- Mobile No. (Registered on UPI)

- Aadhaar Number (Should be linked to a bank account)